Politicians must act after energy price rises

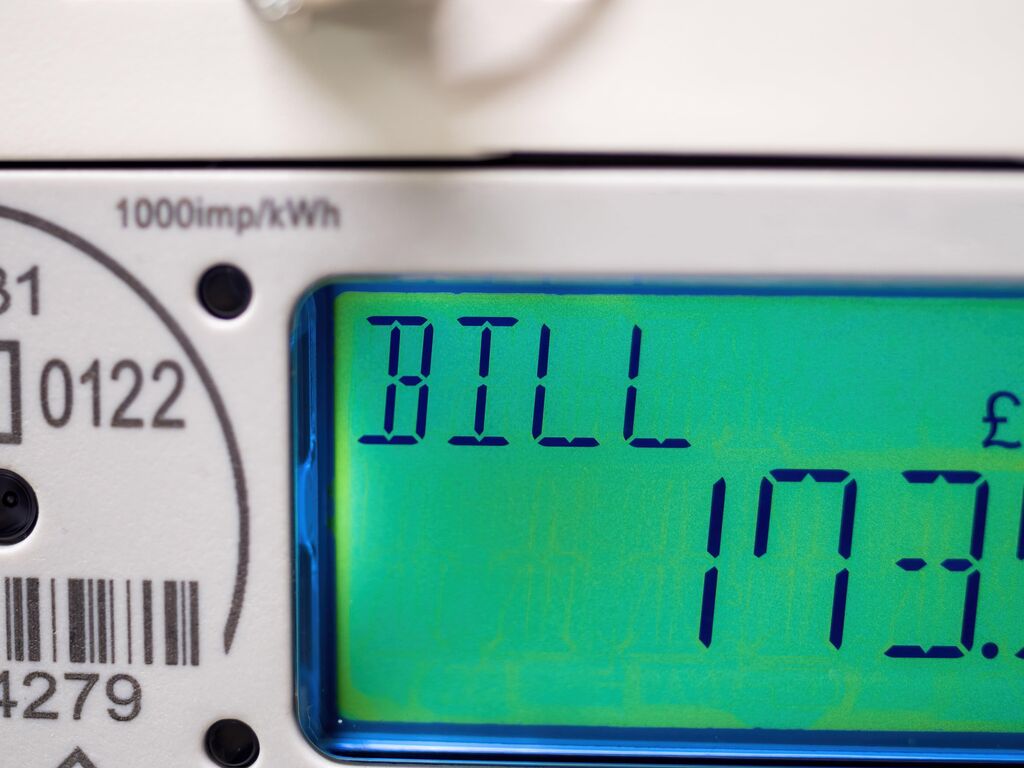

Politicians have a moral duty to act in the wake of a shocking rise in the energy price cap in Great Britain, CARE has said.

Today, we join dozens of organisations in demanding immediate action to safeguard the most vulnerable groups.

We are also urging systemic change to the income tax system to help the hardest-hit families in the long term.

Speaking this morning, James Mildred, Director of Communications and Engagement at CARE, said:

"The brutal reality is that for millions of families and individuals across the country, this latest price cap rise, coupled with inflation, means they will be forced to choose between eating and heating. Children are being advised to wear extra layers. Pensioners who live alone are having to weigh up whether they can afford to put the heating on. It's truly bleak.

"As a Christian organisation, we believe political leaders have a moral duty to act in the interests of the most vulnerable people in society, who are uniquely cherished by God himself. Throughout the Bible, God expects advocacy for the poor, orphans, widows and outsiders. Those in authority come under a particular responsibility to ensure their welfare.

"We urge political leaders in the UK to do the right thing and see that the poor and the frail are not abandoned in months to come. Action is needed in the short term to respond to shocking rises, and protect life. We'd also urge Ministers to consider systemic change, to equip those who are always struggling with bills to survive in today's climate.

"The current approach to taxation, which focuses on the individual, means that families are paying more in tax than households with no dependents. This is simply unjust. In the cost-of-living crisis, it is households with children or other caring responsibilities who are being hit hardest. A reformed tax system can help them weather the storm."

CARE campaign for income tax reform

A recent CARE report, produced in partnership with fiscal policy experts Tax & the Family, argues that the current approach to taxation is inherently unfair. It states:

"The UK tax system does not treat families fairly. The amount of tax that they pay bears little relationship to how well off they are. Many families in poverty pay income tax. Some in the bottom half of the income distribution even pay higher rate tax and are liable for the HICBC. This problem, which has been ignored by successive Chancellors, is a serious one, and needs to be tackled.

"Latest data from the ONS indicates that there are 27.8 million households in the UK.16 Nearly 8 million of these households are families with dependent children: 5.26 million couples with one or two children, 0.94 million couples with three or more, and 1.67 million single parent families.

"Families with a single income (one-earner couple families and single parent families) are the most disadvantaged by the income tax system. Our figures also suggest that families with two equal incomes may have higher tax liabilities than households without dependents. This unfairness is due to the fact that UK income tax is based on the individual and has little regard for family responsibilities."

Read the full report here: CARE-and-Tax-the-Family-tax-report-2022.pdf

About CARE

Christian Action Research and Education (CARE) provides analysis of social policy from a Christian perspective. For more information or to request an interview, contact press@care.org.uk

Share